| | |

| Education is the First Step - Understanding the gender health gap and women’s unique health needs to provide better care(tenue le 27 mars 2025) Good diagnosis precedes good treatment. In this presentation we will examine the history of women’s exclusion from medical studies, gender bias and stereotyping in medicine, and the consequences of these. With that history in mind, we’ll explore where women’s health is today, the physiology unique to a women’s body, and the big 3 M’s: Menstruation, Maternity and Menopause. Last, we’ll consider the role of employers in employee health and how the benefit plan can support good diagnosis and good treatment. Organisé par ICRA Manitoba, Nord de l'Alberta, Sud de l'Alberta, Saskatchewan et Pacifique Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | |

| Six Months In: A Review of the CAP Guideline Changes(tenue le 19 mars 2025) Employee benefits fraud costs organizations millions each year and jeopardizes the sustainability of benefit plans. Are you equipped to identify and address this growing issue? The Canadian Pension & Benefits Institute (CPBI) invites you to an exclusive online session featuring two industry experts: Lori Power - Benefits Advisor and author of "They'll Never Know: Summary of Some of the Best and Worst Known Insurance Stories Across the Decades". Jil Tanguay - Health Benefits Fraud expert with extensive experience in uncovering fraudulent claims within the insurance industry. Organisé par ICRA Nord de l'Alberta Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | |

| Strategies for Addressing Trapped Surplus in Defined Benefit Plans(tenue le 13 mars 2025) Six months have passed since the Canadian Association of Pension Supervisory Authorities (CAPSA) released its revised Guideline No. 3 for Capital Accumulation Plans (CAPs) and the new Guideline No. 10 for Risk Management. In this follow-up session, our panel of experts will provide a comprehensive review of how pension plan sponsors and service providers are adapting to the changes. Join our expert panel as they discuss key trends, challenges, and best practices that have emerged in the six months following the release of these important guidelines. This session will also explore the evolving regulatory landscape and offer practical insights on compliance and risk management moving forward. Don’t miss this opportunity to gain a deeper understanding of how to navigate the CAP guidelines in practice and stay ahead of regulatory developments. Organisé par ICRA Pacifique Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | |

| Strategies for Addressing Trapped Surplus in Defined Benefit Plans(tenue le 27 février 2025) This session explores the connection between rising interest rates and DB plan surpluses, delves into what "trapped" surplus means, and outlines various coping mechanisms. Attendees will gain insights into available strategies, including improving plan benefits, de-risking, using surplus to cover administrative expenses, taking contribution holidays, employer refunds, and exploring innovative solutions. With a focus on maintaining confidentiality and navigating these complex issues effectively, this presentation offers practical approaches to managing surplus and ensuring optimal outcomes for DB plans. Organisé par ICRA Saskatchewan Prix membre 20$ Prix non-membre 55 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Retraite 1 - Revue générale des concepts(tenue le 20 au 21 février 2025) Cette formation s’adresse aux personnes qui désirent acquérir une connaissance générale des principaux éléments relatifs aux régimes de retraite. Concepts clés : types de régimes de retraite, environnement légal, placement de la caisse, survol des aspects actuariels. ** Une attestation vous sera remise à la fin de la formation. Organisé par ICRA Québec Prix membre 195 $ Prix non-membre 325 $ Prix étudiant 100 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Placement 1 - Revue générale des concepts(tenue le 13 au 14 février 2025) S’adresse aux personnes qui désirent acquérir une connaissance générale des principaux éléments relatifs à l’investissement. Concepts clés : catégories d’actifs, rendement vs risque, allocation cible, recherche de gestionnaires, suivi des gestionnaires. * Une attestation vous sera remise à la fin de ce cours. Organisé par ICRA Québec Prix membre 195 $ Prix non-membre 325 $ Prix étudiant 100 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Overview of Executive Compensation Strategies to Attract and Retain Key Talent(tenue le 30 janvier 2025) This session will explore critical employment law considerations for both hiring and terminating employees. It will cover essential elements to include in employment agreements, with a focus on severance provisions and deferred compensation plans. Attendees will gain insights into the potential costs of terminating long-service employees, particularly when factoring in promises related to total compensation. The session will also provide an update on recent case law regarding the enforceability of non-compete and non-solicitation clauses. Organisé par ICRA Saskatchewan Prix membre 20 $ Prix non-membre 55 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| 2025 Economic Outlook - Presented Online(tenue le 21 janvier 2025) Presenter:

Randall Bartlett, Deputy Chief Economist, Desjardins Group Based in Toronto, Randall leads a team covering the Canadian and provincial economies & housing markets outside of Quebec, as well as government budgets & fiscal policy. Before coming to Desjardins, Mr. Bartlett was the Director of Economic Research on OMERS' Total Portfolio Management Team, where he was responsible for global economic research and forecasting. Prior to that, he was the Chief Economist at the Institute of Fiscal Studies and Democracy, where he published Canadian economic, fiscal, and policy analysis. He has also held positions at PSP Investments, TD Economics, the Office of the Parliamentary Budget Officer and the federal Department of Finance. Organisé par ICRA Manitoba Prix membre 25 $ Prix non-membre 65 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Pharmacy 2.0: How ePharmacies Are Transforming Access to Care(tenue le 14, janvier 2025) As the prevalence of chronic conditions increases and access to care continues to be a challenge, pharmacists stand out as the most accessible primary care providers in Canada. The typical pharmacy model has shifted over recent years from typical brick-and-mortar retailers to digital options that can be accessed anywhere and at any time. These ePharmacies offer a new and innovative way to improve access to care, revolutionize the pharmacy experience and create meaningful results for patients and plan sponsors. This presentation dives into the current pharmacy landscape in Canada and how ePharmacies are playing a pivotal role in changing the landscape. Organisé par ICRA Pacifique Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Navigating the CAP Guideline Changes – What sponsors need to know(tenue le 4 décembre 2024) On September 9, 2024, the Canadian Association of Pension Supervisory Authorities (CAPSA) released the long-awaited final revisions to Guideline No. 3 – Guideline for Capital Accumulation Plans (CAPs) and the new Guideline No. 10 – Risk Management for Pension Plans. Join our panel of experts including… Corinne Ah Choon, Director, Investments & DC at Eckler, Marc-Antoine Morin, AVP Chief Product Owner - Member Engagement at Manulife and Allyson Marta, Partner at Fasken, to hear what has changed and implications for plan sponsors and service providers. Organisé par ICRA Sud de l'Alberta Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

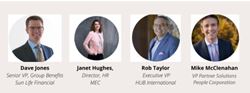

| Showcase series: Supporting success from the top down(tenue le 28 november 2024) In this Mental Health training session presented by Sun Life, we will explore the five stages of developing a workplace Mental Health strategy: Laying the foundation, identifying opportunities, setting priorities and objectives, taking action, and continuously reevaluating the process. Organisé par ICRA Nationale Prix membre 0 $ Prix non-membre 0 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| The Wild West of Pensions Regulators(tenue le 27 november 2024) Join us for a unique opportunity to hear about pension regulatory developments from Western Canada’s pension regulators, including the BC Financial Services Authority, Alberta Treasury Board and Finance, and the Financial and Consumer Affairs Authority of Saskatchewan. Speakers will provide the latest regulatory updates and share their areas of regulatory focus in the coming years. Organisé par ICRA Sud de l'Alberta, Nord de l'Alberta, Saskatchewan et Pacifique Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Retirement and Employment Benefit Plans: A Legal Update(tenue le 14 novembre 2024) This session will cover pension and tax regulation, changes to CRA policies, employment standards and employment benefits, recent caselaw and broader legal developments impacting retirement and benefits plans. The session will focus on the implications of these changes for plan sponsors and administrators. Organisé par ICRA Sud de l'Alberta, Nord de l'Alberta et Pacifique Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Bridging the Gap: Improving mental health through reimagined employee assistance programs(tenue le 30 octobre 2024) With one in three Canadians reporting worsened mental health, especially with most believing that their financial situation has a greater impact on their mental well-being than any other factor, including physical health, family, or work situation, employers are expected to step in. Alarmingly, 43% of Canadians lack the financial resources to access professional mental health care. Meanwhile, 47% of working Canadians depend on employer benefits to improve their well-being, yet over half have not utilized their Employee Assistance Program (EAP), despite it being offered by most employers. This underscores the urgent need for more accessible and targeted support through EAPs and virtual primary care, ensuring that employees can effectively address mental health challenges Organisé par ICRA Sud de l'Alberta Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| CPBI Ontario Webinar - Scoping Out Special Risks(tenue le 26 septembre 2024) Operating a business globally has become the standard practice, but it comes with its own set of risks. Geopolitical tensions, terrorism, natural disasters, and the threat of kidnapping are just a few examples of the challenges that organizations face when operating internationally. To counter these risks, special insurance coverage could help mitigate the unique set of challenges that come with conducting business across borders. Organisé par ICRA Ontario Prix membre 10 $ Prix non-membre 25 $ Prix étudiant 10 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Ateliers : Élaboration d’une politique de placement et comment structurer son portefeuille en actions (tenue le 25 septembre 2024) La première partie de cet atelier consistera à couvrir, de manière pratique, les différentes étapes qui sont entreprises lors de l’élaboration d’une politique de placement dont l’élément le plus important est l’allocation cible. En effet, de 85% à 90% du risque d’investissement proviendra de l’allocation cible qui aura été choisie. Organisé par ICRA Québec Prix membre 300 $ Prix non-membre 450 $ Prix étudiant 145 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Navigating Cybersecurity Challenges and Defenses(tenue le 12 septembre 2024) We are excited to bring you a 2 part webinar:

Part 1: Beyond Technology: Unveiling Human Behavior in Cybersecurity and Social Engineering

Part 2: Data Breach Live! - Hacking Techniques & How Cyber Insurance Can Provide the Last Line of Defense Organisé par ICRA Pacifique Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| CPBI Ontario Webinar - Regulatory Round-Up and Case Law Update – 2024 in review(tenue le 10 septembre 2024) This webinar will provide an overview of the current landscape, the challenges ahead and the ways in which private plans and their stakeholders are affected by this new program. You'll have a better understanding of the complex factors at play, and insights to better navigate the changing landscape of national pharmacare implementation. Organisé par ICRA Ontario Prix membre 10 $ Prix non-membre 25 $ Prix étudiant 10 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| The Evolution of Workplace Wellness(tenue le 26 juin 2024) While wellness practices date back to 3000 BC, the term 'wellness' was coined back in 1961. Since then, workplace wellness strategies have evolved significantly. Key Session Discussion Points: What have we achieved as a society regarding employee wellness in the workplace? Are employees better off due to these strategies, and how do we measure it? Have we sacrificed core employer values in the name of wellness? Organisé par ICRA Nord de l'Alberta Prix membre 25 $ Prix non-membre 40 $ Prix étudiant 25 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Cancer and Critical illness in the Workplace(tenue le 29 mai 2024) Part 1: A Glimpse into the Cancer Journey: An overview of the evolving landscape of cancer in 2024 Part 2: The Economic Burden of a Critical Illness Diagnosis Organisé par ICRA Pacifique Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Cutting Through the Noise – Turning Responsible Pension Investment Insights to Actions(tenue le 11 mai 2024) Navigating and understanding the broader landscape of investment risks and opportunities has never been more important. Join Aon’s North America Head of Responsible Investing, Daniel Ingram, and a Saskatchewan based Investment Consultant with Aon, Erin Achtemichuk for an insightful discussion on key Responsible Investment (RI) topics, including: - Key differences between RI approaches

- Practical examples for implementation

- Aon's four-pronged RI framework and beliefs

Organisé par ICRA Saskatchewan Prix membre 20 $ Prix non-membre 55 $ Prix étudiant 20 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| CPBI Ontario Webinar - Macro markets outlooks and global equity considerations for institutional investors(tenue le 14 mai 2024) Around the world, asset managers are seeking to generate innovative ideas to help meet institutional client’s investment goals, but with over 55,214 listed public traded companies across 80 major stock exchanges (as of December 2023), finding the next winner is often easier said than done. That is why having a macro perspective to global equity investing is key. Please join us as we discuss how plan sponsors should best navigate the deep and vast global equity markets to deliver best-in-class results. Organisé par ICRA Ontario Prix membre 0 $ Prix non-membre 0 $ Prix étudiant 25 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Webinar WSIB Pension Plan – Journey from Single Employer to Jointly Sponsored Pension Plan(tenue le 14 avril 2024) In this session, our expert speakers will share their experiences on the WSIB pension plan’s journey to a jointly sponsored pension plan. The WSIB and the Ontario Compensation Employees Union worked in partnership to transform the plan from single-employer sponsorship to the JSPP that it is today. Organisé par ICRA Ontario Prix membre 0$ Prix non-membre 25 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| 2024 CPBI Saskatchewan Regional Conference VIRTUAL(tenue le 11 avril 2024) An amazing line-up of speakers and topics was assembled for the 2024 CPBI Saskatchewan Regional Conference. Organisé par ICRA Saskatchewan Prix membre 449 $ Prix non-membre 809 $ Prix étudiant 279 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

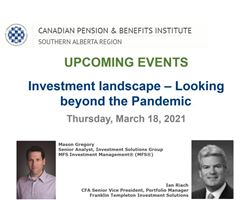

| Economic Outlook & Investment Strategy: 2024 and Beyond(tenue le 11 avril 2024) One continuing education credit in partnership with the Insurance Council of Manitoba or the Saskatchewan Insurance Council will be offered. A certificate of attendance will be issued upon request. A short quiz must be completed at the conclusion of the session in order to qualify for a CE Certificate. Organisé par ICRA Manitoba & Saskatchewan Prix membre 25 $ Prix non-membre 65 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| B.C.: The New Frontier for DB and TB Pension Plan Funding(tenue le 10 avril 2024) The session will review how the Target Benefit (TB) Plan and Defined Benefit (DB) Plan funding rules have changed in B.C. We will highlight what the old rules were, and how the new rules have interacted with changes in the economic environment to allow more pension plans to deliver benefit improvements recently. Topics covered will include: - Summary of old rules and issues they created

- Summary of the improved new rules

- Examples of how TB and DB plans comply with the new rules

- Ideas on how the funding changes have allowed plan design to evolve

- Summary of differences in Alberta and Saskatchewan

Organisé par ICRA Pacifique Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Formation - Placement de base(tenue le 9 avril 2024) Cette formation s’adresse aux personnes qui désirent se familiariser avec les principes de bases en placement. Nous ferons un survol des concepts suivant: les classes d'actif, le rendement/risque, la gestion d'un portefeuille de placement et le choix des gestionnaires. * Une attestation vous sera remise à la fin de ce cours. Prix membre 290 $ Prix non-membre 440 $ Prix étudiant 145 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Our Government's Impact On Benefit Plans: A Legislation Update(tenue le 3 avril 2024) Employers are focused on providing an Employee Value Proposition that incorporates an engaging employee benefits offer that is simultaneously well-balanced and market competitive. But the work world is changing and so are employee expectations. Economic uncertainty continues to impact business practices. Markets are being tested by skills and labour shortages in some areas and oversupply in others. Inflationary pressures are felt by employers and employees alike. Year over year, it becomes more challenging for employers to deliver benefits plans that are both cost effective and relevant to employees. Employers are equally tasked with staying on top of legislative changes that impact the way their benefits plans are designed and delivered. This session will provide a high level look at recent legislative changes at the federal and provincial level (with primary focus on Alberta and British Columbia) that are impacting benefit plans today. Organisé par ICRA Nord de l'Alberta, Sud de l'Alberta & Pacifique Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Charting Unique Pathways: Enhancing Member Experience(tenue le 27 mars 2024) Join us for an insightful session titled "Charting Unique Pathways: Enhancing Member Experience," where we delve into the pivotal realm of Member Experience Journey Mapping. Discover the profound impact of positive member experiences on engagement, retention, and overall satisfaction. Uncover the art of creating compelling member journey maps through a step-by-step process, including data collection, mapping the journey, and identifying opportunities for innovation. Organisé par ICRA Saskatchewan Prix membre 20 $ Prix non-membre 55 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| BENEFITS 101(tenue le 20 mars 2024) In this session, you will learn from several industry experts about: - Principles of Group Insurance

- Components of a Benefits Plan

- Plan Design Options

- Underwriting, Pricing & Funding Arrangements

- Role of the Plan Administrator

- Employee Communication

- On the Horizon

Organisé par ICRA Sud de l'Alberta Prix membre 105 $ Prix non-membre 185 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Service Canada Presents: Canada Dental Care Plan Explained(tenue le 12 mars 2024) Join us on Tuesday, March 12 - Service Canada Citizen Service Specialist Vickey Williams will provide an overview of the new Canadian Dental Care Program (CDCP). Vicky will share enrollment and eligibility criteria, coordination of benefits, what services are covered and will answer questions which may be submitted in advance of the presentation. Organisé par ICRA Manitoba Prix membre 25 $ Prix non-membre 65 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| The Pulse on Pensions: What Practitioners Need to Know in 2024(tenue le 7 mars 2024) This session will cover legal, legislative and regulatory updates including: - A discussion of recent pension law cases,

- The federal Pension Protection Act and what it means for employers with DB plans,

- CAPSA’s draft Risk Management Guideline and how administrators can prepare for its release.

Organisé par ICRA Pacifique Prix membre 79 $ Prix non-membre 119 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Les technologies au service de la gestion de l’invalidité(tenue le 29 février 2024) Les technologies au service de la gestion de l’invalidité telles que l’intelligence artificielle et l’analyse prédictive. Cette session s'adresse à des généralistes RH, des travailleurs du milieu de l’assurance, des courtiers, des entrepreneurs ou des dirigeants. Organisé par ICRA Québec Prix membre 25 $ Prix non-membre 40 $ Prix étudiant 15 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Innovations in Defined Contribution Plans((tenue le 28 février 2024) As the Canadian pension landscape shifts from defined benefit pension plans to defined contribution plans, we are seeing the challenges facing retirees as they transition from growing their retirement accounts during their working years to converting them to income for retirement. In this session, we will look at the limitations of the current options available to retirees, and then look to the future at new solutions, including Advanced Life Deferred Annuities, Variable Pension Life Annuities, and other innovations designed to better support retirees in securing predictable and affordable income through retirement. Organisé par ICRA Saskatchewan Prix membre 20 $ Prix non-membre 55 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| CPBI Ontario Webinar - Fostering the wellbeing of women at work(tenue le 27 février 2024) From menstruation to menopause, family planning and beyond, women* face unique health challenges that are often misunderstood or overlooked in the workplace. Investing in the health and wellness of women fosters a culture of caring and can have numerous positive effects, both for the individuals and the organization. Some key benefits are improved employee morale, positive impacts on mental health, increased productivity, better work-life balance, minimized absenteeism and support for recruitment and retention. Organisé par ICRA Ontario Prix membre 15 $ Prix non-membre 25 $ Prix étudiant 15 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Health is Wealth: Employer ROI is to focus on Mental Health and Financial Health(tenue le 21 février 2024) Holistic health and wellness are made up of many facets, but which ones are most intertwined with where we work? What is the highest want and need for Employees? What is the highest impact for Employers? Workplace mental health and financial health. Learn more about how the workplace can influence employee mental health and financial health and how data shows they are intricately linked. Organisé par ICRA Sud de l'Alberta Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Avantages sociaux et relevés de fin d'année(tenue le 25 janvier 2024) En tant qu'entreprise vous devez inscrire certains avantages ou déductions sur les feuillets fiscaux de vos employés. Cette séance fera un survol des principales obligations en la matière, et des meilleures pratiques entourant la communication pour que vos employé(e)s profitent au maximum de leur déclaration d'impôts et évitent des erreurs ou des oublis courants. Cette présentation s'adresse aux employeurs de toutes tailles, aux professionnels et professionnelles des ressources humaines, de la rémunération et des avantages sociaux. Organisé par ICRA Québec Prix membre 25 $ Prix non-membre 40 $ Prix étudiant 15 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Tools & Resources to Build a Healthy Workplace(tenue le 24 janvier 2024) This session will provide you with information on how to build the healthiest workplace for your organization. Today, more than ever, employees and their families are seeking tools and resources to help them through their days, whether it be for the stress of the daily struggle, the challenges they are facing in today's economy, or trying to plan for their future while they feel the world is working against them. There are endless amounts of programs and resources that can be shared with your employees to help them feel supported so they can give their best at work and home. Join us in this hour long session to learn effective ways to enhance your current wellness programs. Organisé par ICRA Pacifique Prix membre 25$ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Prévisions économiques 2024(tenue le 17 janvier 2024) Nous sommes présentement à un point où il y a passablement de divergence sur les vues des spécialistes en matière économique et financière. L’économie est-elle, ou va-t-elle aller en récession? Si oui, verra-t-on une faible récession ou une récession sévère? Les taux d’intérêt vont-ils demeurer relativement hauts ou baisser en 2024? S’ils baissent, quand cela arrivera-t-il? Certains anticipent un rendement positif sur les marchés boursiers en 2024. Est-ce réaliste? Venez écouter nos trois panélistes qui vous aideront à y voir plus clair sur ce qui risque d’arriver en 2024 au niveau économique et financier. Nos deux panélistes qui étaient présents l’an dernier en profiteront pour revenir sur leurs prévisions d’alors. Organisé par ICRA Québec Prix membre 100 $ Prix non-membre 150 $ Prix étudiant 45 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Élaborer un régime d’avantages sociaux adapté aux besoins de votre entreprise au Québec(tenue le 30 novembre 2024) Cette formation s’adresse aux personnes qui désirent se familiariser avec les principes de bases en assurance et rentes collectives. Les participants apprendront comment concevoir et mettre en place un régime d’avantages sociaux adapté aux besoins de leur entreprise selon sa culture, le budget, et l’impact voulu sur sa marque employeur. Finalement ils apprendront comment utiliser leur régime pour obtenir un meilleur rapport qualité prix. Organisé par ICRA Québec Prix membre 290 $ Prix non-membre 440 $ Prix étudiant 145 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Artificial intelligence is here to stay: Are we prepared?(tenue le 21 novembre 2023) Artificial Intelligence (AI) is an area of significant interest and poised to have a greater impact for pensions and benefits industry participants. As this field continues to emerge, CPBI is committed to shedding light on the potential governance, legal, and regulatory implications that may arise.

The panel discussion will address the specific impact and implications of AI in the industry. Panelists will be share their perspective from human resources, legal, and regulatory points of view.

Attend this session to to learn how AI is shaping and will continue to shape the pension and benefits landscape and whether the industry is prepared for these changes.

This session is valuable for fiduciaries, plan sponsors and individuals who have a governance role in plans and those advising them in this emerging area. Organisé par ICRA Nationale, Atlantique, Ontario, Manitoba, Saskatchewan, Alberta Nord, Alberta Sud et Pacifique. Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Symposium ICRA Quebec(tenue le 2 novembre, 2023) Le 2 novembre, joignez-vous à vos pairs et aux experts de l'industrie pour le Symposium en ligne 2023 de l’ICRA, offert en partenariat avec l’IFEBP.

Rejoignez des collègues influents du secteur pour explorer des solutions innovantes en matière de pensions, d'avantages sociaux et d'investissements, présentées par des promoteurs de régimes, des consultants et des professionnels aguerris. Le tout offert en ligne, en français. Organisé par ICRA Québec Prix membre 290 $ Prix non-membre 440 $ Prix étudiant 145$ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Symposium ICRA Quebec(tenue le 2 november 2023) Le 2 novembre, joignez-vous à vos pairs et aux experts de l'industrie pour le Symposium en ligne 2023 de l’ICRA, offert en partenariat avec l’IFEBP.

Rejoignez des collègues influents du secteur pour explorer des solutions innovantes en matière de pensions, d'avantages sociaux et d'investissements, présentées par des promoteurs de régimes, des consultants et des professionnels aguerris. Le tout offert en ligne, en français. Organisé par ICRA Québec Prix membre 195 $ Prix non-membre 295 $ Prix étudiant 100 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| The Wild West of Pensions Regulators(tenue le 19 octobre 19 2023, en anglais) Join us for a unique opportunity to hear about pension regulatory developments from Western Canada’s pension regulators, including the BC Financial Services Authority, Alberta Treasury Board and Finance, the Financial and Consumer Affairs Authority of Saskatchewan, and the Manitoba Financial Services Agency. Speakers will provide the latest regulatory updates and share their areas of regulatory focus in the coming years. The Canada Revenue Agency will also provide an update on recent regulatory developments and insights into upcoming changes. Organisé par ICRA Pacifique, Nord de l'Alberta, Sud de l'Alberta, Saskatchewan et Manitoba. Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Régimes de retraite niveau 1(tenue le 16 au 17 octobre 2023) Cette formation s’adresse aux personnes qui souhaitent acquérir des notions générales sur l’ensemble des aspects entourant la gestion et l’administration des régimes de retraite. Organisé par ICRA Québec Prix membre 400 $ Prix non-membre 600 $ Prix étudiant 200 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Mental health in the workplace: What do we do now?(tenue le 4 octobre 2023, en anglais) While the shadows of the pandemic are beginning to fade, mental health issues aren't: 1 in 3 Canadians are still living with mental health disorders. For employers already struggling with a shortage of employees and who've spent the past 2 years investing in health and wellness initiatives, the situation is even more puzzling.

This presentation, which is based on an extensive study by The Conference Board of Canada, provides an overview of these initiatives, often rolled out in response to urgent needs. Organisé par ICRA Pacifique Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Formation - Régimes de retraite de base(tenue le 4 octobre 2023) Cette formation s’adresse aux personnes qui désirent se familiariser avec les principes de bases des régimes de retraite.

* Une attestation vous sera remise à la fin de ce cours. Organisé par ICRA Québec Prix membre 175 $ Prix non-membre 280 $ Prix étudiant 90 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| The Road to Better Outcomes: 2023 MFS Global Retirement Survey(tenue le 13 septembre 2023, en anglais) A member informed, is a member engaged. Join MFS to learn what members are telling us about the various facets of the group retirement space in Canada through the key findings of the 2023 MFS Global Retirement Survey. This presentation of survey results explores many topics including: - Target Date Funds: what characteristics do member's value, and how are they using or misusing target date funds

- Retirement Planning and Advice: what forms and methods do members prefer to receive when planning for the future

- Retirement Confidence: What are the main factors contributing to overall confidence related to a members' financial wellbeing

- ESG: the demand for and incorporation into retirement plans

Plan sponsors and their partners will walk away with actionable takeaways to help lead effective conversations related to member engagement, communication and plan participation.

TOrganisé par ICRA Pacifique Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| CPBI Ontario Webinar - Should ESG and DEI be integrated into retirement programs?(tenue le 11 juillet 2023, en anglais) Where do retirement programs land in the backdrop of growing ESG and DEI advocacy and progressive corporate policy? Our panel will discuss the potential for integration of these issues in retirement programs, availability of investment products, and potential conflicts that may arise. Organisé par ICRA Ontario Prix membre 25 $ Prix non-membre 40 $ Prix étudiant 15 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Option 2 Ateliers : Élaboration d’une politique de placement et comment structurer son portefeuille en actions(tenue le 23 juin 2023) La première partie de cet atelier consistera à couvrir, de manière pratique, les différentes étapes qui sont entreprises lors de l’élaboration d’une politique de placement dont l’élément le plus important est l’allocation cible. En effet, de 85% à 90% du risque d’investissement proviendra de l’allocation cible qui aura été choisie.

Ainsi, dans un premier temps, cet atelier permettra aux participants de vivre une situation réelle d’établissement de l’allocation cible. La première étape consistera à passer en revue comment les hypothèses économiques devraient être établies. Par la suite, un rapport contenant des analyses sur différentes allocations cible sera revu en détail. Suite à des discussions sur le rapport, des éléments seront ajoutés aux analyses initiales afin d’aider à déterminer l’allocation cible qui devrait être choisie. À cet égard, une attention particulière sera portée au risque que représentent les différentes allocations. Enfin, cette partie de l’atelier portera sur la mise en place des différents autres éléments faisant partie de la politique de placement. Organisé par ICRA Québec Prix membre 290 $ Prix non-membre 440 $ Prix étudiant 145 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| CPBI Ontario Webinar - Should ESG and DEI be integrated into retirement programs?(tenue le 11 juillet 2023, en anglais )

Where do retirement programs land in the backdrop of growing ESG and DEI advocacy and progressive corporate policy? Our panel will discuss the potential for integration of these issues in retirement programs, availability of investment products, and potential conflicts that may arise. Organisé par ICRA Ontario Prix membre 25 $ Prix non-membre 40 $ Prix étudiant 15 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| FORUM 2023(tenue le 5 au 7 juin 2023, en anglais) Saviez-vous que vous pouviez consulter les présentations antérieures du FORUM 2023 ? Si vous n'étiez pas inscrit à la conférence en direct , vous pouvez choisir de vous inscrire maintenant et d'accéder à tout le contenu à la demande. Organisé par ICRA Nationale Prix membre 349 $ Prix non-membre 675 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Obesity: The Science, Impacts and Strategies(tenue le 24 mai 2023, en anglais )

Obesity is on the rise globally and efforts to address it are challenging due to misconceptions about obesity and the role it plays in a person’s health. By 2035, it is expected that 1 in 4 people will be living with obesity which is estimated to be 1.9 billion people. The estimated global economic impact of obesity by 2035 is $4.32 trillion dollars. This session will dive deeper into the science, misconceptions and complexities of this chronic disease, along with strategies employers can use to improve healthy outcomes. Organisé par ICRA Nord de l'Alberta, Sud de l'Alberta, Saskatchewan et Manitoba Prix membre 25 $ Prix non-membre 40 $ Prix étudiant 15 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| CPBI Ontario Webinar - Re-thinking mental-health absence and disability management: Innovative new ways to support return to work(tenue le 9 mai 2023, en anglais )

Studies have shown that the Canadian economy loses at least $50 billion annually due to mental-health issues and that chronic conditions such as depression and anxiety are major reasons for long-term disability. These claims are a complex matter for any employer to manage and it can be difficult to know where to start. Join this session to learn best practices in prevention and identifying early warning signs, how to better connect mental-health case management and new mental-health treatments that support returning to work sooner. This will be presented using real case studies and data-driven evidence. Organisé par ICRA Ontario Prix membre 25 $ Prix non-membre 40 $ Prix étudiant 15 ${body}#160; |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| The Evolution of Virtual Healthcare: Embracing Innovation & Bridging the Gaps(tenue le 27 avril 2023, en anglais )

Society has evolved to expect an on-demand digital experience. Workplaces have transformed to have satellite offices, remote locations and more people working from home. How will healthcare keep up with the changing dynamics and our multi-generational workforce? Join us for a moderated panel session with 3 virtual healthcare providers in Canada, to learn more. Discover how organizations are evolving to meet the health and wellness needs of a digital savvy work force. We held this session on June 30, 2020 so we will compare what Virtual Healthcare looks like now compared to 3 years ago! Organisé par ICRA Sud de l'Alberta Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Show Me the Money: Rewards in a Changing Environment(tenue le 26 avril 2023, en anglais )

In this session, Carolyn Kildare from Mercer will share insights from Mercer’s global and local research on compensation and rewards trends. We will touch on the key findings from Mercer’s Global Talent Trends study, delve into what’s on employee’s minds, and consider trends in total rewards and compensation. Organisé par ICRA Manitoba Prix membre 25 $ Prix non-membre 65 $ Prix étudiant 25 ${body}#160; |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Régimes de retraite et gouvernance climatique(tenue le 18 avril 2023, en anglais )

Cette présentation est présentée d’un point de vue stratégique; pourquoi faut-il instaurer une gouvernance climatique au sein d’un CA d’un régime de retraite?

Les thèmes abordés seront: - Court portrait des changements climatiques, ses conséquences et les actons requises

- Risques climatiques (physiques et de transition)

- Obligations légales des fiduciaires (opinion de Randy Bauslaugh)

- Stratégies d’investissement qui tiennent compte du risque climatique

- Évolution de la réglementation et des soft law (ACOR, TCFD, ISSB, etc.)

- Litiges climatiques

- Remplir ses devoirs fiduciaires en tant que régime de retraite.

Organisé par ICRA Quebec Prix membre 25 $ Prix non-membre 40 $ Prix étudiant 15 ${body}#160; |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Benefits & Underwriting 201(tenue le 13 avril 2023, en anglais )

In this webinar, we’re going to explore what really makes your benefits plan “tick”. What are employees really looking for? What are typical “blind spots” employers ignore that drive up costs and claims? Why is benefits communication so vital? What are the pitfalls of benchmarking? Join Kandy as we walk through issues and practical ideas that can take your benefits plan from “blah” to “yeah”! Organisé par ICRA Pacifique Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Best practices of Pension and Benefit Communication(tenue le 23 mars 2023, en anglais )

In this presentation, Nicole Quintal will explore the rapidly changing technology landscape and the opportunities it may present to enhance pension and benefits communications. Organisé par ICRA Saskatchewan Prix membre 20 $ Prix non-membre 55 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| CPBI Ontario Webinar - Inpatriate Benefit Solutions(tenue le 21 mars 2023, en anglais ) Canada’s labour market is more dependent than ever on inpatriate workers to address worker shortages and demographic changes due to the declining birthrate and retiring baby boomers. Ottawa’s ambitious plan to welcome 500,000 immigrants per year by 2025 will help boost the workforce, as will temporary foreign workers, work permit holders, and Canadian expatriates returning home. These individuals may not be eligible for provincial or territorial health coverage for some time upon arrival leaving them with a gap in coverage. An inpatriate healthcare plan protects visitors to Canada, including workers, international students, and embassy employees, until they qualify for provincial healthcare, or for their full work term in Canada. Organisé par ICRA Ontario Prix membre 25 $ Prix non-membre 40 $ Prix étudiant 15 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| DC Pension Plans Update(tenue le 9 mars 2023, en anglais ) Neil Lloyd and Dasha Zuck will discuss current trends and some future developments impacting Capital Accumulation Plans, their members, and the companies that sponsor these arrangements. Organisé par ICRA Pacifique Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Pension & Benefit Legal Update(tenue le 16 février 2023, en anglais ) Join Sean Maxwell, from Blake, Cassels & Graydon LLP as he gives an update on: - Legislative and regulatory developments over the past year of interest to administrators of pension plans with Alberta & BC members,

- Recent case law developments involving pension and benefit arrangements and potential discrimination complaints that may arise in the context of such plans, and

- Considerations for employers in developing COVID-19 related testing and vaccination requirements in the workplace.

Organisé par ICRA Sud de l'Alberta, Nord de l'Alberta et Pacifique Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Cyber Security 2.0 – Revenge of the Insider(tenue le 1 février 2023, en anglais ) Building on the Cyber Heroes presentation, we’ll talk more about how security concepts and approaches apply to those that are on the “inside” and could be intentionally, or more often accidentally, part of a cyber security issue you could end up having to manage. There will be some repetition from the earlier presentation but more detail or explanation where appropriate. Attendance of the previous presentation will not be necessary but attendees of that presentation will likely have more awareness of some of the concepts. Organisé par ICRA Saskatchewan Prix membre 20 $ Prix non-membre 55 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Virtual Care and EAP 101(tenue le 12 janvier 2023, en anglais) Employee Health & Wellness programs are evolving. Quickly. According to the September 2022 Benefits Canada Health Survey, 29% of plan sponsors now include a virtual health care (or telemedicine) service as part of their benefits plan offering. In addition, only 39% of employees are satisfied with the level of service provided by their employer's existing Employee Assistance Programs. Join us as Jon and Natasha take us through a discussion of how virtual care & EFAP continues to impact the Canadian workplace, what the future may have in store, and why that matters to employers. We will discuss the key challenges these programs are designed to address and the preliminary results thus far. Organisé par ICRA Pacifique Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Moving from stress to security: Financial well-being supports and education(tenue le 24 novembre 2022, en anglais) Financial well-being is when you’ve met your current commitments and needs comfortably and have the financial resilience to maintain this in the future. It can mean having control over your finances, being able to navigate a financial setback, meeting your financial goals or having the freedom to make choices that let you find balance in your life. Financial well-being has become important to Canadians and relevant to everybody in some way. This session is hosted by CPBI Saskatchewan Prix membre 20 $ Prix non-membre 55 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Best Practices of Employee Group Benefits(tenue le 17 novembre 2022, en anglais) Analyzing and negotiating employee benefits at renewal is vital to the skill set of an HR professional. In this CPBI session, we will examine the advanced tools and best practices that employee benefit providers use in formulating packages. This knowledge will strengthen the expertise and effectiveness as a HR professional and skilled negotiator. The course is focused on group benefits from a payroll, human resources and financial point of view. Attending will provide a blueprint on how your benefits providers create employee group benefits programs. Organisé par ICRA Sud de l'Alberta Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Tools to Create a Healthy Work Culture(tenue le 16 novembre 2022, en anglais) Join us November 16, 2022, for an online CPBI London Ontario session on Tools to Create a Healthy Work Culture. Our 1-hour session from 1:00 pm ET will have two great speakers. Harriet Ekperigin from Green Shield Canada will discuss the impact of mental health on the Canadian workforce and tools employers can engage to support this growing population. Neena Gupta, an employment and human rights lawyer and partner at Gowling WLG will follow with a discussion on the legislation in place to support employees including the objectives of the most recent Right to Disconnect legislation. The pandemic has blurred the lines between work and personal life driving a higher incidence of burnout and flagging gaps. Neena will discuss the organizational culture shift required to address these gaps. Attendees will walk away with areas of focus to explore within organizations to help identify possible changes in keeping with the intention of legislation. Organisé par ICRA Ontario Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Virtual Health - The Rise Of Virtual Care: Why Now?(tenue le 3 novembre 2022, en anglais) The last few years have dramatically changed how we interact with the world, including how we choose to receive physical and mental health care. Although virtual care had started to carve out its place in the Canadian landscape before COVID-19, the pandemic significantly accelerated its adoption across the country. Join us as we explore: What is Virtual Health and how does it work? Why are Canadian patients and clinicians choosing to use it? What are employers looking for when considering virtual care as part of their employee benefits strategy? Organisé par ICRA Nord de l'Alberta Prix membre 25 $ Prix non-membre 40 $ Prix étudiant 15 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Drug Plan Management(tenue le 27 octobre 2022, en anglais) An overview and commentary on topics such as: National Pharmacare, Industry Updates, Canadian Pharmacy Landscape, Biosimilars, and Cost Control Management. Organisé par ICRA Saskatchewan Prix membre 20 $ Prix non-membre 55 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Cyber Risk Management and Insurance Considerations(tenue le 20 octobre 2022, en anglais) Join us to hear from Dan Lewis, Senior Vice President, Canadian Management Liability Practice Leader at Gallagher. Dan will give a perspective of the current cyber threat landscape that all organizations are dealing with and dive into what cyber insurance is, what it provides and the critical first steps sponsors need to take to become insurable. Organisé par ICRA Sud de l'Alberta Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Pension and Employee Benefits Updates for 2022(tenue le 18 octobre 2022, en anglais) This session will provide an overview of key recent legislative, regulatory and caselaw updates across the country for pension and employee benefits for employers and plan administrators. In particular, this session will cover trends in the industry as well as recent releases from the Canadian Association of Pension Supervisory Authorities, the Financial Services Regulatory Authority of Ontario, and the federal Department of Finance on a number of topics. Organisé par ICRA Ontario Prix membre 25 $ Prix non-membre 40 $ Prix étudiant 15 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Future of Pharmacy Practice: the pharmacist’s role in enhancing the health of your employees(tenue le 13 octobre 2022, en anglais) This session will provide an overview of key recent legislative, regulatory and caselaw updates across the country for pension and employee benefits for employers and plan administrators. In particular, this session will cover trends in the industry as well as recent releases from the Canadian Association of Pension Supervisory Authorities, the Financial Services Regulatory Authority of Ontario, and the federal Department of Finance on a number of topics. Organisé par ICRA Ontario Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Diversity, Equity & Inclusion (DEI)(tenue le 5 octobre 2022, en anglais) Is your workplace truly inclusive of all its employees? When reviewing your organization with a Diversity, Equity & Inclusion (DEI) perspective, where do you start? This session will share best practices on developing and implementing a comprehensive DEI strategy for workplaces, including legal and reputational risks, responsibilities, and communication and change management considerations. Mercer Canada is a leader in the DEl consulting space, with a network of DEl consultants around the world that help clients create more diverse equitable and inclusive cultures in their workplaces. We conduct global DEI research into the policies, practices, motivations, and organizational structures that companies use to sustain their DEl programs. We have a team with 50 years of experience in building surveys and leading employee diversity research. Most importantly, we strive to "walk the talk": Our Canadian CEO, Jaqui Parchment, is a board member for the Black North Initiative; as a firm, we volunteer with Women in Governance to support their parity certification process; and members of our proposed consulting team are fluent in both national languages and serve as BRG leaders within Mercer focused on women and on race and ethnic diversity. Organisé par ICRA Pacifique Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Attracting and Retaining Talent in a Post Covid era(tenue le 22 septembre 2022, en anglais) Over the past couple of years plan sponsors have been facing increasing pressures with regards to retaining and attracting employees. The new reality of work is comprised of office, hybrid and home workers, which presents unique challenges when developing or reviewing a compensation package that will provide what these three groups of workers may be looking for. Join us for a moderated Q&A where speakers Brent Dul, Executive VP, Integrated Talent Solutions at Randstad and Carolyn Kildare, Principal, Career Services at Mercer Canada discusses the current labour market, employee concerns with the current work environment, budgeting for total compensation, and finally what makes plan sponsors successful in attracting and retaining employees. Organisé par ICRA Sud de l'Alberta Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| The Growth and Implications of Digital Assets(tenue le 20 septembre 2022, en anglais) Digital assets and the blockchain that underpins them is having an impact on institutional investors and their portfolios.

Join CPBI Ontario for a discussion on emerging and evolving technologies, and see how they are impacting the way we do business.

Learn how financial institutions are defining digital assets, the technology being developed to support them and what financial institutions should be aware of and investing in to keep up with growing demand. Organisé par ICRA Ontario Prix membre 25 $ Prix non-membre 40 $ Prix étudiant 15 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Trust Governance and Leadership Practices in Today’s Rapidly Evolving Environment(tenue le 15 septembre 2022, en anglais) The pandemic and other world events over the past couple of years have had significant and varied impacts onplan Trustees. Issues such as mental health and wellness, climate change, reconciliation, racial injustice, innovation, and supply chain pressures are now at the forefront and have implications for this sector like never before. This, in turn, has created unique pressure points for the governance of such plans and their investments. In this engaging panel, senior leaders will highlight emerging trends affecting trustees and discuss the corresponding implications and practice points for governance. Topic areas for discussion may include: - Re-thinking how to set Trustees up for success in their roles through orientation, ongoing development, and meeting practice design

- Reflection of Values and incorporating ESG into decision making -Considerations for ensuring strong Board oversight of critical areas impacting plans and investments (including strategy, risk, ESG, innovation, and other critical areas)

- Framework for Trust Governance -Implications and determination of board responsibilities and composition, including Trustee appointment and succession

- Investment Fiduciary Duties

- Best Practices in Trust Governance/Current State of Practice.

Organisé par ICRA Pacifique Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Disruption by Innovative Pension Plans(tenue le 7 septembre 2022, en anglais) Sponsors are always looking for new and innovative ways of offering pensions. This extended session provides some solutions and food for thought on what some plans are doing in this space. It starts with a speakers panel on Retirement income with a focus on innovative and disruptive retirement plans. We will hear on the challenges and offerings from a multi employer DC pension plan , a group plan and a multiemployer plan. The format is to have these plans speak about their innovative plan in a session along with some other leaders in of innovative retirement plans with a 10 – 15 minute opening remarks followed by an audience Q&A. Organisé par ICRA Pacifique Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| L’inflation : le rôle des banques centrales et des gouvernements et son impact sur les marchés financiers(tenue le 31 août in 2022) Avec un IPC de 7.7% en mai et de 8.1% en juin, l’inflation connait sa plus forte hausse depuis près de 40 ans. Pour tenter de freiner celle-ci, la Banque du Canada a relevé son taux directeur à quatre reprises depuis mars 2022 pour passer de 0.25% en février à 2.50% à la mi-juillet. La dernière hausse d’un point en a surpris plusieurs qui s’attendaient plutôt à une hausse de 0.75 point. La guerre en Ukraine, le niveau de consommation intérieur, la pénurie de main-d’œuvre sont quelques-uns des facteurs qui contribuent à l’augmentation de celle-ci.

Le 31 aout 2022, l’ICRA vous propose une session pour mieux comprendre l'influence des politiques monétaires sur l’inflation et l’impact de cette dernière sur les marchés financiers.

Nos panélistes vous parleront des différents facteurs qui influencent l’inflation et de l’incidence de celle-ci sur les marchés financiers, les taux d’intérêt, etc. Organisé par ICRA Quebec Prix membre 35 $ Prix non-membre 55 $ Prix étudiant 15 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Pension Plan as a Service - Provide a pension plan and stay focused on your business(tenue le 12 juillet 2022, en anglais) Today’s labour market favours sellers, not buyers. You need an edge to get the talent you need in the increasingly fierce competition for skilled employees. Offering a pension plan can help, but how do you do that without taking on the costs, risk, and work of pension management? In this session, attendees will learn about a new way to offer pension programs and whether it may be the right fit for their workplaces. Organisé par ICRA Ontario Prix membre 25 $ Prix non-membre 40 $ Prix étudiant 15 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Benefits & Underwriting 101(tenue le 9 juin 2022, en anglais) Whether you’re new to the employee benefits industry or need a refresher as you jump into a new role, this session is for you! Join Kandy as we talk through all things employee benefits: plan design, funding, basic underwriting considerations, and terminology. Organisé par ICRA Pacifique Prix membre 25 $ Prix non-membre 75 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Atelier : Comment structurer son portefeuille en actions(tenue le 9 juin 2022) Cet atelier sera consacrée à l’établissement de la structure en actions, un élément souvent traité de façon sommaire dans la pratique. Après avoir été informés des différents critères qui devraient être considérés dans l’établissement d’une structure de gestion, les participants auront l’occasion de passer en revue un rapport typique d’établissement d’une structure de gestion en actions. Ce rapport permettra aux participants de comprendre comment des mesures relatives aux rendements peuvent être utilisées afin de déterminer le profil rendement-risque attendu de différentes structures en actions et de voir comment ces structures peuvent se comporter dans différents environnements de marché. Des mesures de complémentarité entre les différents gestionnaires dans la structure seront également présentées. Organisé par ICRA Quebec Prix membre 125 $ Prix non-membre 210 $ Prix étudiant 70 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Atelier : Élaboration d’une politique de placement (tenue le 8 juin 2022) Cet atelier consistera à couvrir, de manière pratique, les différentes étapes qui sont entreprises lors de l’élaboration d’une politique de placement dont l’élément le plus important est l’allocation cible. En effet, de 85% à 90% du risque d’investissement proviendra de l’allocation cible qui aura été choisie. Ainsi, dans un premier temps, cet atelier permettra aux participants de vivre une situation réelle d’établissement de l’allocation cible. La première étape consistera à passer en revue comment les hypothèses économiques devraient être établies. Par la suite, un rapport contenant des analyses sur différentes allocations cible sera revu en détail. Suite à des discussions sur le rapport, des éléments seront ajoutés aux analyses initiales afin d’aider à déterminer l’allocation cible qui devrait être choisie. À cet égard, une attention particulière sera portée au risque que représentent les différentes allocations. Enfin, cette partie de l’atelier portera sur la mise en place des différents autres éléments faisant partie de la politique de placement. Organisé par ICRA Quebec Prix membre 125 $ Prix non-membre 210 $ Prix étudiant 70 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Managing the New Normal 2.0: A Legal Update(tenue le 7 juin 2022, en anglais) Employers continue to navigate new legal frontiers with respect to the impacts of the pandemic on the workforce. It is more important than ever that employers make informed decisions on employment policies and practices.

Our speakers will provide a legal perspective on the ways in which COVID-19 will continue to affect workplaces in Atlantic Canada, even after a return to largely in-person activities, covering such topics as: - Accommodation requests for continued remote work

- Post-mandate vaccine and social distancing practices, and related privacy and safety concerns

- Maintaining a psychologically healthy and respectful workforce

- Litigating the COVID-19 fallout – trends in employee claims

- Engagement and retention strategies

Organisé par ICRA Atlantique Prix membre 30 $ Prix non-membre 50 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Assurance collective - 2 jours : choisir son assureur ou son mode de gestion(tenue le 31 mai au 1 juin 2022 ) Cette formation s’adresse aux personnes qui désirent se familiariser avec les principes de bases en assurance et rentes collective et qui doivent prendre des décisions par rapport aux fournisseurs de services retenus. On y explorera les types d'ententes de services qui peuvent exister, le mécanisme d'appel d'offres et comment choisir son assureur et interpréter les tarifications proposées. On discutera aussi de la gestion générale du dossier d'assurance collective. Organisé par ICRA Quebec Prix membre 175 $ Prix non-membre 280 $ Prix étudiant 90 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Pharmacogenetics – Leveraging genetics to improve patient treatment and reduce spending(tenue le 26 mai 2022, en anglais) Pharmacogenetics is increasingly being used by healthcare providers to improve the safety and effectiveness of medications. This medical advancement aims not to treat the patient as a statistic but rather as an individual with unique characteristics that make them more or less suited to take certain medications. As mental health issues become amplified within the current global context, providers of healthcare management services are looking for medical innovations to maximize the efficiency of patient treatments. With its ease of use and demonstrated benefit, pharmacogenomics has positioned itself as a stepping-stone towards integrating precision medicine in medication therapy management programs. Organisé par ICRA Saskatchewan Prix membre 20 $ Prix non-membre 55 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Resilience and Respect in the Workplace(tenue le 19 mai 2022, en anglais) Many challenges can arise in an employee’s life that will test their resilience. These include workplace stress and adversity, financial difficulties, relationship problems and health issues. Poor resilience on an individual employee level can weaken overall business resilience. Productivity can decline, absence and associated costs can increase and the retention of valuable employees can suffer. Poor resilience on an individual has compounding effects on respect in the workplace. Resilience in the workplace cannot be fostered without a solid foundation of respect for one another. They go hand in hand. There are many solutions that can help. Resilience isn’t static – and all employees can learn, training and further develop it. Whether someone is naturally resilient or not, they can build their resilience over time. Resiliency truly is a muscle that people can use and grow. Diversity, inclusion and belonging, when embedded effectively, ties into leadership and management seamlessly. It isn’t a program, but a shift in how organizations operate. It’s accepting that things like privilege and bias exist and many of us bring those things to work with us every day, sometimes with little awareness that they’re happening. We don’t know what we don’t know, and it’s simplistic to think we can fix things quickly with little effort. Our focus is better served through discussions around inclusion and how to “get familiar with the unfamiliar.” It is important to remember that diversity is a fact, inclusion is a choice. You can have diversity and not have inclusion. When you focus only on diversity but fail to help your diverse team feel included, your team may not feel valued – in that case, you’ve just collected a lot of different people who are in the room or in the company together. Organisé par ICRA Sud de l'Alberta Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Gender Implications for Pension and Benefit Plans- hosted by CPBI Atlantic(tenue le 18 mai 2022, en anglais) With the expanded recognition of non-binary and transgender identification in society and at law, pension and benefit plan sponsors are reconsidering how gender impacts program design, delivery and governance. The female longevity vs pension savings gap is coming under increased scrutiny by DC plan sponsors but what else do plan sponsors need to consider when it comes to gender? How should gender data be collected and used … if at all? What are the obligations with respect to inclusive design and equitable outcomes? Please join us as pension and benefit experts explore the practical and legal implications of these questions as well as evolving market practices. Organisé par ICRA Atlantique Prix membre 30 $ Prix non-membre 50 $ Prix étudiant 30 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Post-COVID Perspectives on Pension and Benefits Plans(tenue le 17 mai 2022, en anglais) COVID presented us all with new workplace realities. What did we learn? What changed legally? What insights did we gain about developing more effective and attractive workplaces and more effective and attractive pension and benefit arrangements to give our organizations an advantage in terms of cost efficiencies, responsiveness and attracting and retaining talent? This interactive session will explore these themes from both a legal and a management perspective. Organisé par ICRA Ontario Prix membre 25 $ Prix non-membre 40 $ Prix étudiant 15 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Pension Administration Fundamentals Certificate(tenue le 16-19 mai 2022, en anglais) This program is recommended for professionals working in the pension adminstration field for at least a year or more. This is an opportunity to enhance your skills and learn about best practices in the administration of registered pension plans. Organisé par ICRA Manitoba Prix membre 400 $ Non Member Rate 600 $ Prix étudiant 400 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| EAP and Beyond - Rethinking Employer Mental Health Programs(tenue le 10 mai 2022, en anglais) The last two years has had a profound effect on the mental health and wellbeing of many people. Well before the pandemic, mental illness was already the number one driver of absence and disability. COVID dramatically changed both the prevalence and severity of mental health across populations – as did the demand for support, which has put enormous pressure on delivery systems. Employee Assistance Programs (EAP) are now just one tool in an ever growing toolkit to support employee’s mental wellbeing. In this session, C.J. and Adam will share interesting data and trends around mental health with respect to key lessons in last 24 months. They will also share insights around innovative new programs that are helping to solve the treatment gap and a better level of connected care. Organisé par ICRA Manitoba Prix membre 25 Prix non-membre 65 $ Prix étudiant 25 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Diversité, l'équité et l’inclusion en assurance collective(tenue le 28 avril 2022, en anglais) Diversité, l'équité et l’inclusion en assurance collective... De plus en plus d'employeurs gèrent activement l'équité, la diversité et l'inclusion et les régimes d'avantages sociaux sont appelés à changer en conséquence. Cette session examinera certains aspects de l'ÉDI avec un survol des pratiques et des initiatives des assureurs, que ce soit des choix plus inclusifs dans les formulaires et les sites de promoteurs ou les nouveaux types de prestations telles que les garanties d'affirmation du genre. Organisé par ICRA Quebec Prix membre 20 $ Prix non-membre 30 $ Prix étudiant 15 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Decumulation: What is the problem we are trying to solve? A discussion with Neil Lloyd and Pat Leo(tenue le 21 avril 2022, en anglais) Please join us for an informative and engaging discussion with Neil Lloyd, Partner and Western Canada Wealth Leader at Mercer Canada, and Pat Leo, VP, Longevity Retirement Solutions at Purpose Investments. The discussion will focus on decumulation and provide insights into the following: - What is decumulation?

- When is the right time as a plan sponsor to think about incorporating a decumulation strategy?

- How should plan sponsors think about decumulation?

- How is the decumulation discussion evolving in other other countries?

- What should plan members be thinking about as they approach their decumulation phase?

- VPLAs, ALDAs, Variable Benefits.

Organisé par ICRA Sud de l'Alberta Prix membre 25 $ Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Creating a Health Culture; Understanding the Health Continuum(tenue le 20 avril 2022, en anglais) People are an organization’s most valuable asset. Your employees’ physical and mental well¬being are crucial to your organization’s smooth operations and profitability. This is a shared responsibility that clearly belongs to each individual, but to the employer as well, who can make a difference. From prevention to an employee’s return to work, solutions must be put in place to support your employees and managers in any situation they might encounter at work.

Learn how to make prevention a key part of your strategy in order to: - Take positive steps regarding key factors to promote the health of your organization’s people and financial assets

- Be proactive by offering your employees the right services at the right time

- Assess the impact of your initiatives and generate results

Organisé par ICRA Ontario Prix membre 25 $ Prix non-membre 40 $ Prix étudiant 15 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Economic Outlook Revisited: The Impact of Global Conflict(tenue le 12 avril 2022, en anglais) In a few short months, much has changed in the world. War between Russia and Ukraine, the fallout of economic sanctions and rising oil prices, the NDP/Liberal alliance in Canada, and countries loosening COVID-19 restrictions in an effort to keep their economies moving forward. But what does this all mean for markets that have already seen a lot of turbulence in the first few months of 2022? What is the outlook for interest rates and inflation given everything that is occurring? This session will revisit our expectations for the economy both domestically and globally, and focus on what we might expect for the rest of 2022 and looking forward into 2023 as key themes for various markets in a time of continued uncertainty. Organisé par ICRA Manitoba Prix membre 25 $ Prix non-membre 65 $ Prix étudiant 25 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Pension Design Innovation for the 21st Century(tenue le 7 avril 2022, en anglais) This session will highlight the results of recent major legislative changes affecting defined benefit and target benefit pension plans and also provide an overview of BCFSA’s risk-based supervision framework which has been expanded to include the supervision of defined contribution pension plans. Organisé par ICRA Pacifique Prix membre 25 $ Prix non-membre 75 $ |

| RInscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Régimes de retraite niveau 1 - Modules 1 à 8(tenue le 29 mars au 7 avril 2022, en anglais) Cette formation s’adresse aux personnes qui souhaitent acquérir des notions générales sur l’ensemble des aspects entourant la gestion et l’administration des régimes de retraite.

* Donne 12 UFC en ACP à la Chambre de la Sécurité financière et

12,25 heures de formation reconnues par le Barreau du Québec

** Un nombre minimum d'inscriptions est requis pour que le cours soit offert Organisé par ICRA Quebec Prix membre 260 $ Prix non-membre 400 $ Prix étudiant 130 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |

| Mental Health and Sustainable Return to Work: Supporting Employees Returning From Disability(tenue le 24 mars 2022, en anglais) How do we effectively support employees when they are off work as a result of mental illness? This talk will explore the organizational foundations necessary to ensure employees have access to right supports while they are off work and you understand how a comprehensive mental health strategy can support managers to effectively bring staff back after a leave. Understanding the roles manager and human resources play in supporting staff and accommodating their return can be pivotal to the overall health and culture of an organization. What impact have we seen on group benefit plans as it relates to mental health drug and disability claims throughout the pandemic. This talk will provide a brief comparison look over the past 3 years on drug and disability trends and changes concerning mental health, and how we’re adapting and responding to these changes. It will explore how Canadians are responding in general, and most importantly speak to how group insurers, like iA, are pivoting to better support plan sponsors and plan members with mental health related conditions and challenges. The session will outline preventative and wellness solutions relating to mental health, and offer practical tips on how best to preserve workers in the workplace and ease employees back to work more quickly, safely and sustainably after a disability and amidst the pandemic. Organisé par ICRA Sud de l'Alberta Prix membre 25 ${body}#160; Prix non-membre 40 $ |

| Inscrivez-vous en ligne pour recevoir le lien de l’enregistrement

|

| | | |